How To Know If You Qualify For TurboTax Settlement in Minnesota + Wisconsin

Tax season is now over for the year. However, the popular tax-filing program TurboTax has been sued and will now pay $141 million to customers across the United States.

But how exactly do you know if you qualify and does it differ from state to state?

According to Kare11, the website ran an ad campaign of "free, free, free" and that mislead many people across the states. New York Attorney General Letitia James stated her investigation into Intuit was sparked by a 2019 ProPublica report that found the company was using deceptive tactics to steer low-income tax filers away from the federally supported free services for which they qualified.

The software company Intuit that powers TurboTax, Credit Karma, and others, offered two free versions of TurboTax. One for taxpayers with “simple returns" and the other for taxpayers earning roughly $34,000 and members of the military.

According to The Wisconsin Department of Justice, Wisconsin Attorney General Josh Kaul, "more than 76,000 Wisconsinites ended up paying for tax preparation products that were marketed as being ‘free'," The Department of Justice also stated that they secured $2,370,000 from the owner of TurboTax, Intuit Inc.

Going over the Land of 10,000 Lake, Minnesota Attorney General Keith Ellison secured more than $1.8 million in refunds. Ellison also stated:

Part of my job of helping Minnesotans afford their lives is protecting them from predatory corporations. I joined this investigation and settlement because Intuit’s business practices defrauded Minnesotans. The settlement we’ve reached will put money back in the pockets of low-income consumers that Intuit deceived into paying for tax-preparation services that should have been free

Intuit has also agreed to reform its business practices, including:

- Refraining from making misrepresentations in connection with promoting or offering any online tax preparation products;

- Enhancing disclosures in its advertising and marketing of free products;

- Designing its products to better inform users whether they will be eligible to file their taxes for free; and

- Refraining from requiring consumers to start their tax filing over if they exit one of Intuit’s paid products to use a free product instead.

Alright, so exactly qualifies for this settlement? Under the agreement, Intuit will provide restitution to consumers who started using the commercial TurboTax Free Edition for tax years 2016 through 2018 and were told that they had to pay to file even though they were eligible for the version of TurboTax offered as part of the IRS Free File program.

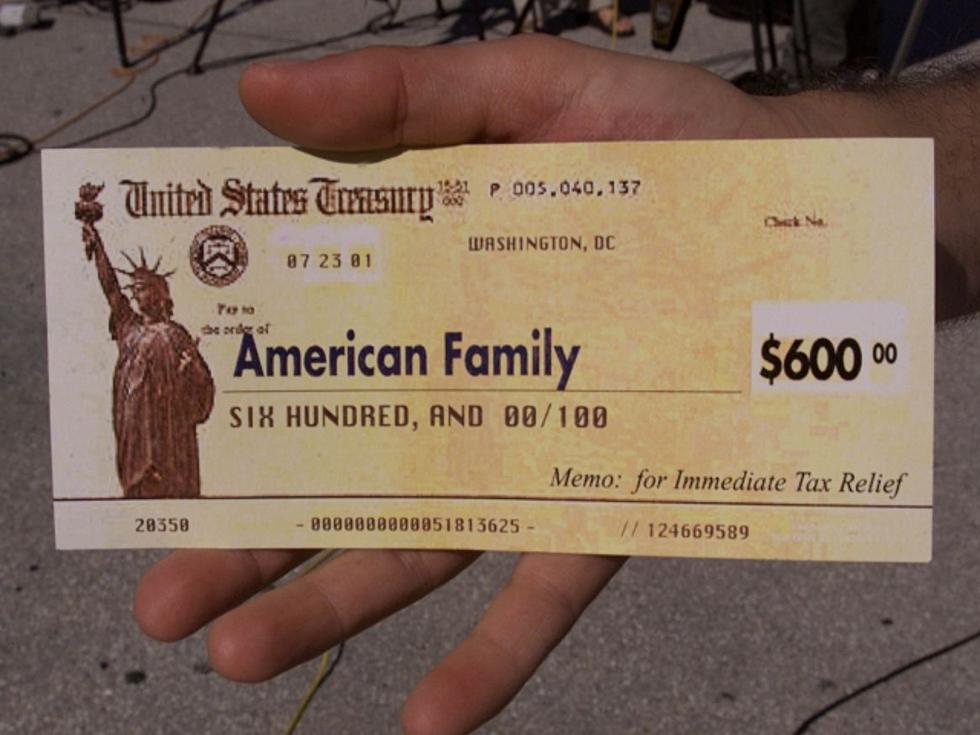

CNET noted that no action needs to be taken. People are expected to receive a direct payment of approximately $30 for each year that they were deceived into paying for filing services. Customers will also receive the notice and checks by mail.

If you're hoping on getting more money with this settlement, how about I try to lighten the mood with some funny tweets about taxes:

Celebrities Who Ran Into Serious Tax Troubles

More From KOOL 101.7